Taking stock of the role that ATMs can play in the future of banking provides insights for credit unions as they adapt to the changing needs and preferences of their members. Use this interactive tool to help you visualize the possibilities of the ATM.

Click through each tab below to consider how the ATM may serve as a tool for advancing your credit union's strategies for marketing, branch transformation, experience, privacy and inclusion.

CONTEXT

→ The ATM serves as a billboard for the credit union (advertising and branding)

→ A reassuring, convenient touchpoint conveying presence and accessibility

FEATURES

→ Wrapping and logo of the ATM

→ Wait screen promoting other products while transactions process (Yes/No option to be contacted by a representative regarding additional products)

→ Consistent brand experience across website, mobile applications, and ATM experience

→ Integration with coupon and loyalty programs (either through supplying points or QR codes for discounts at surrounding businesses)

CONTEXT

→ A self-service channel as a branch substitute

→ Expands the CUs geographic footprint and hours of service

FEATURES

→ Proximity to well-trafficked retail locations to promote visibility and accessibility

→ More precise withdrawals

CONTEXT

→ Enhancing the member experience through providing tailored support to advance financial well-being, connecting technology-driven self-service to personalized human service

FEATURES

→ Card-less, contactless ATM access with NFC technology and QR codes for mobile integration

→ Personalized welcome screens to create warm and friendly service

→ Permission-based data collection

CONTEXT

→ ATMs as advancing data privacy and trust

FEATURES

→ Integrations with e-commerce to allow members to pay for transactions using cash at the ATM

→ Protection against skimming and spies through contactless payments or provision of one-time code for withdrawing cash via a CUs mobile application

→ Biometric authentication of identity

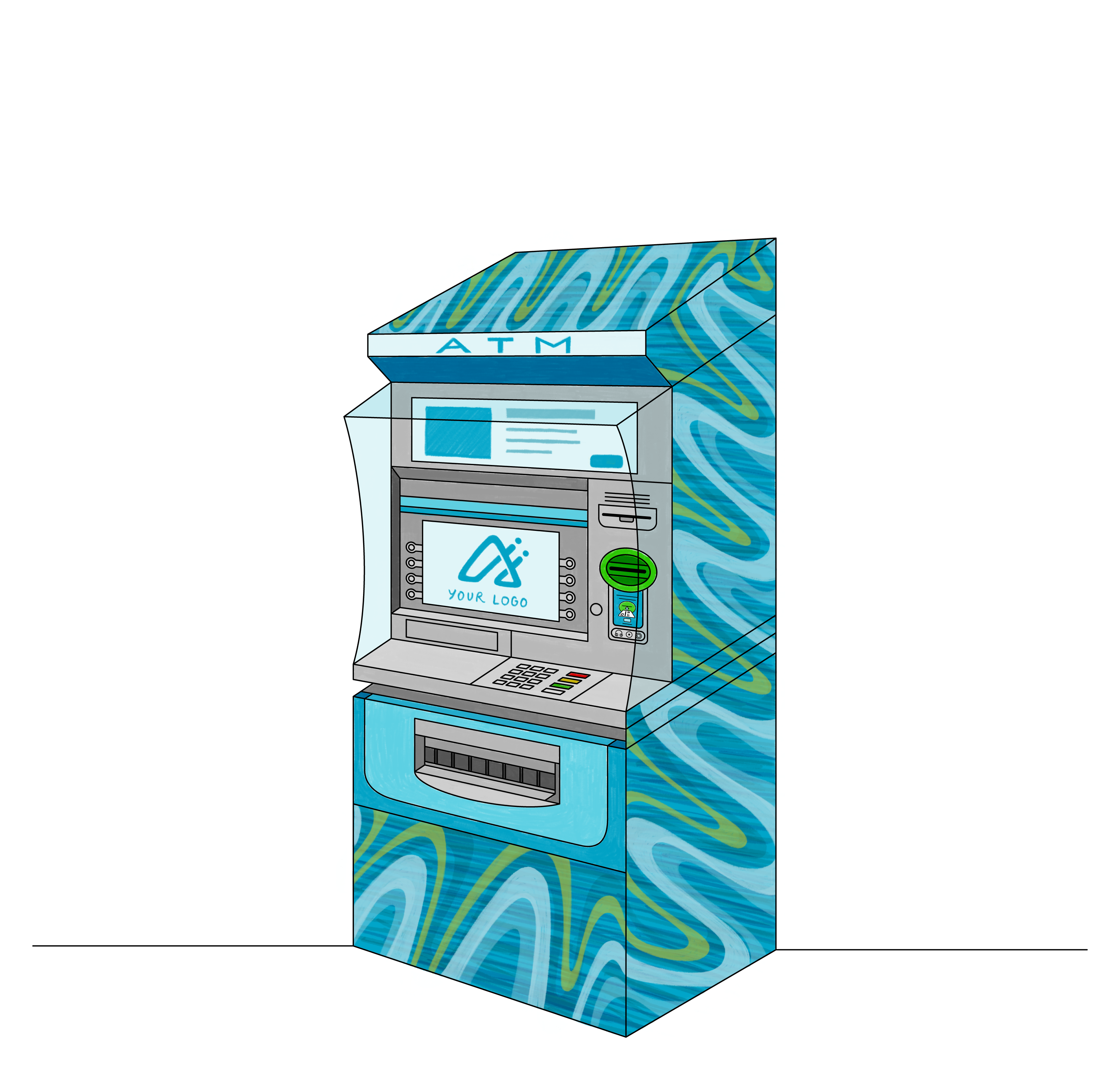

CONTEXT

→ ATMs as bridging the digital divide

→ Access to cash

FEATURES

→ Allowing members to upload cash to an online profile (like Amazon), in addition to conventional functions like deposits and withdrawals

→ Bill payment functionality; ability to purchase plane and public transit tickets

→ ATMs are accessible and safe, complying with ADA regulations

→ Options to select greater levels of personalization (e.g. language preference)